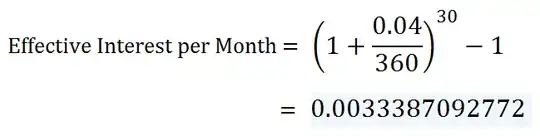

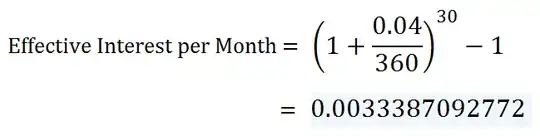

Since the compounding period and payment period differs (Compounded Daily vs Paid Monthly), you need to find the effective interest rate for one payment period (month).

This means that each month you pay 0.33387092772% of the outstanding principal as interest.

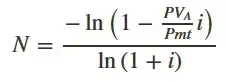

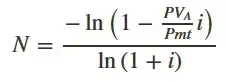

Then use this formula to find the number of months:

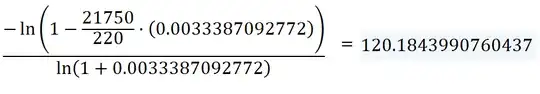

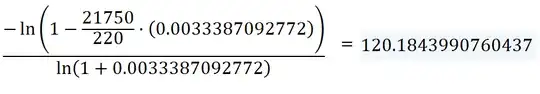

Where PV = 21750, Pmt = 220, i = 0.0033387092772

That gives 120 Months.

Depending on the day count convention, (30/360 or 30.416/365 or Actual/Actual), the answer may differ slightly. Using Financial Calculator gives extremely similar answer.

The total cash paid in the entire course of the loan is 120 x $220 = $26,400