I've had several employer-provided plans through Fidelity over the years.

Fortunately, they offered extremely low-cost passive investment options, like Vanguard Institutional Index Trust, which tracks the S&P 500 with a cost of only 0.01%-0.02% depending on share cost.

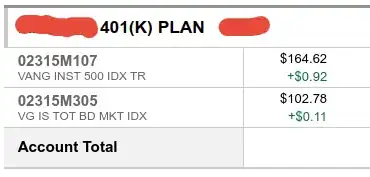

One strange thing about these funds is that they don't have public ticker symbols. Here's an example:

If I Google 02315M107, Google (somehow) knows that I am looking for the Vanguard Institutional 500 Index Trust fund, and if I google 02315M305 it knows I'm looking for Vanguard Total Bond Market Index Fund Institutional Shares… even though I can't actually find those symbol anywhere on the public web.

Annoyingly, even though these funds appear to be just "share classes" of publicly-known Vanguard mutual funds, their prices don't match. The only way that I know of to find their current prices is to login to my Fidelity account, so I can't use any kind of automated quote-lookup software to track them.

Is there any public service for looking up the prices/NAVs of these funds that only exist inside specific companies’ retirement plans?