In terms of the risk graphs, your thought process is correct. If you combine a Short Butterfly with a Long Straddle, you end up with the risk graph of the green line. Unfortunately, because options cost money, there are no free lunches and that is the error in your assumption. Now I know that you're not going to accept that explanation on face value so let's try something more technical.

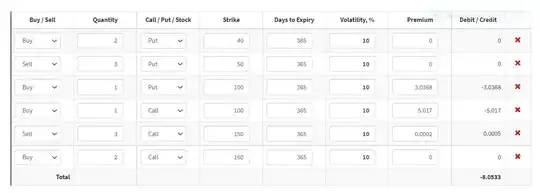

There are 6 basic synthetic positions relating to combinations of Puts, Calls and their underlying Stock. It's called the Synthetic Triangle:

Synthetic Long Stock = Long Call + Short Put

Synthetic Short Stock = Short Call + Long Put

Synthetic Long Call = Long Stock + Long Put

Synthetic Short Call = Short Stock + Short Put

Synthetic Short Put = Long Stock + Short Call

Synthetic Long Put = Short Stock + Long Call

There are additional synthetic combinations. For example, a Bullish Vertical Spread is equal to Long Collared Stock. A bullish debit Vertical Spread is equivalent to a bullish credit Vertical Spread when options of the same strikes and series are used. Once you understand the Synthetic Triangle, you can simplify complex positions into positions with fewer legs. That has two benefits. First, it's often easier to visualize the simplified position's P&L and second, you incur less frictional costs when you transact with fewer legs.

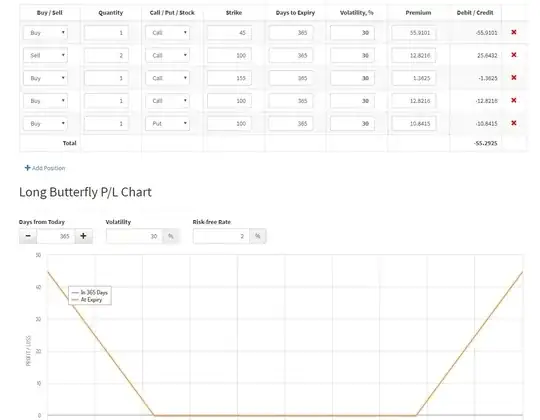

A Butterfly Spread is comprised of a bullish and bearish Vertical Spread with a common central strike. It can be constructed several ways and they all have a similar R/R. Using the Synthetic Triangle you can verify that the following three positions are equivalent:

1) Buy one $95p, sell two $100p, buy one $105p

2) Buy one $95c, sell two $100c, buy one $105c

3) Buy one $95 put, sell one $100p, sell one $100c, buy one $105c

Now, let's take # 3 and add a long straddle at the center strike and simplify the equation. We then have:

- +1 $95p +1 $105c (Long Strangle)

The green line in your graph is the P&L of a Long Strangle. The problem is that you assumed that it would be free and you put the horizontal line at ZERO. Long Strangles aren't given out for free. They cost money. The base of your green line graph belongs in negative territory and that will always be the risk.