Am a beginner in option trading. Recently started learning option strategies. The long straddle looked particularly appealing. However to make a profit the underlying needs to move, lets say around 2%. Is there any technique by which we can reduce this gap down to 0.5% range?

Asked

Active

Viewed 223 times

2 Answers

1

A long straddle gains value if implied volatility increases and/or the underlying moves away from the strike price. It loses value due to double sided time decay. Those are its dynamics.

You can reduce the 2% threshold by:

- using lower IV options (less chance of a big move)

- buying nearer term expiries (disadvantage of higher rate of theta decay)

- utilizing defined risk strategies that have a cap (butterfly, iron condor)

Bob Baerker

- 77,328

- 15

- 101

- 175

0

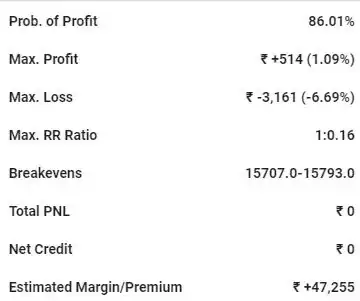

Thank you Bob for quick response. Tried and compared different strategies and came up with this one. Please comment.

Martin

- 173

- 2

- 7