I like Dr Stanley's work, "Stop Acting Rich" being my favorite.

The equation above is lacking. A 20 year old can't have two years income saved, and by 50, one should have a bit more than 5 times.

I wrote a brief saving spreadsheet, in which you can load your present numbers, saving rate and assumed rate of return. Part of the issue is how to decide on your end goal. If you start by assuming you'll need to replace 80% of your pre-retirement income, you'll need about 20 times your final pay to let you withdraw 4% per year. that may seem a lot, but after adjusting for social security, most people are in the 15x range (i.e. they need to save about 15 times their final earning by the time they retire). The spreadsheet shows this is an achievable number. Saving just over 10% from the time you start working and getting an average 8% return will put you there. (Obviously, the 8% is one man's guess, who can say what the next 40 years will bring?)

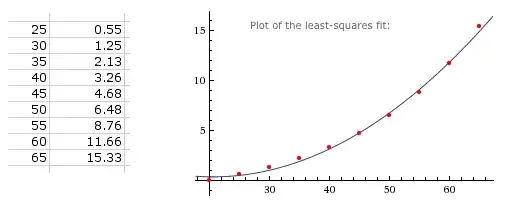

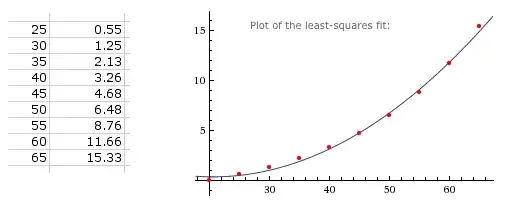

From a similar question What size "nest egg" should my husband and I have, and by what age? this is a snippet of the sheet I referenced. Keep in mind, it's more to illustrate the growth by age. It represents the numbers of years income saved at a given age. The income increases account for inflation. For the numbers I ran, the example shows at age 65, a savings of 15X final income which should replace 60% of final earnings. Social Security presumably will cover another 30-40% or so.

EDIT - A visit to Wolfram Alpha produced the graph above and its corresponding equation:

0.00739394x^2-0.303927x+3.44661

which, in my opinion, adds little value to the discussion. Although, it does show that the number isn't a straight line, and any attempt to produce an 'age minus X times Y' type of goal is going to be misleading. The spreadsheet approach, whether mine or one of your own creation, is going to be accurate and more important, tied to your own numbers.