There's a bit of working backwards that's required.

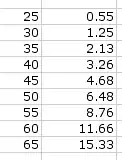

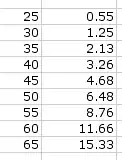

This is a summary of a spreadsheet I wrote which helps to get to the answer. What you see here is that at age 25, one might have saved about a half year's salary, assuming they worked 5 years. The numbers grow exponentially to at 65, about 15 years salary saved. This will allow a withdrawal of about 60% final income each year using the 4% guideline. More will come from Social Security in the States to get closer to 100%.

The sheet start with assumptions, a 10% per year rate of saving, and an 8% annual return. Salary is assumed to rise 3% per year.

One can choose their age, enter their current numbers and their own assumptions. I had to include some numbers and at the time, 8% seemed reasonable. Not so sure today. What I do like is the concept of viewing savings in terms of 'years salary' as this leads to replacement rate. Will $1M be enough for you? Only you can answer that. But the goal of 80-100% replacement income is reasonable and this sheet can be used to understand the goals along the way.

(note, the uploaded sheet had 15% saving rate, not the 10 I thought. I used 15 to show a 10% saving along with a 5% match to one's 401(k). Those interested are welcome to enter their own numbers. The one objection I've seen is the increase to salary. Increases tend to be higher in the first 20 than the second, or so I'm told.)