You need to do detective work to see how the lender is treating loan periods of less than a month. Fortunately, there's enough information to do the job, without knowing the assumptions. The thing to remember is that the interest rate and how to apply it is a fluid number, subject to exaggeration, inflation, and deceit, but the payment schedule is real and concrete. So...

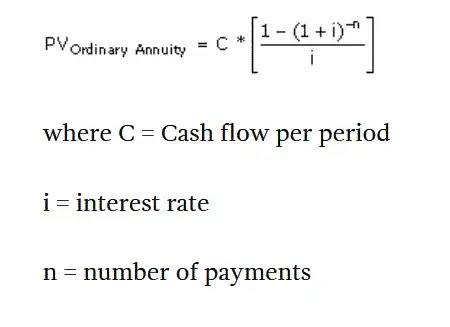

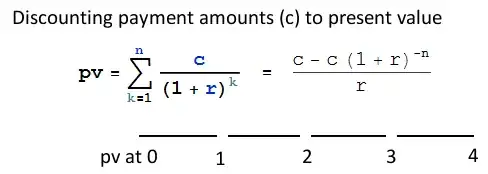

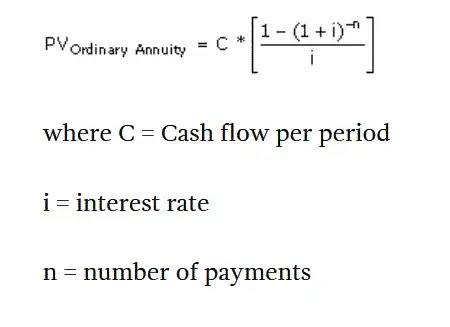

First, calculate the principal amount of an ordinary annuity, at 0.6666666% per month, that is paid off by 36 monthly payments of $3140.50 Use a mortgage calculator, or this formula:

This turns out to be $100,219.03. This is the present value of an ordinary annuity which starts, naturally enough, one month before the first payment, or on Jan 11

Now, that is the present value of the mortgage of Jan 11. We can now switch to monthly compounding. Multiplying this Jan 11 value by a months interest, 1.0066666666666, gives a value as of the first payment on February 11, of $100,887.15 So the original debt has grown by the addition of $887.15 of interest.

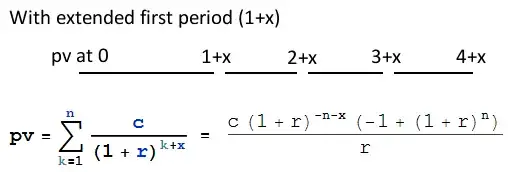

As to justifying this amount of interest for the first part of the loan, that would require a knowledge of how the lender chose to treat partial periods. Trying this guess:

- Take the 8% per year, compounded monthly

- Divide by 12 and add 1 to get the monthly growth factor; 1.0066666666

- Raise this monthly growth factor to the 12th power to get the effective annual growth factor;

- Raise this annual growth factor to the (1/365) power to get the daily growth factor

- Raise this daily growth factor to the 10th power to get the growth factor for 10 days;

- Multiply by the original $100,000

And we get..... 100218.68, not the 100,219.03

So the method above is not the one the lender has chosen to apply. (Unless rounding errors are included...)