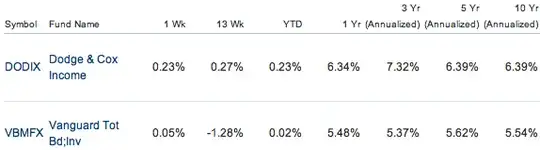

I'm considering an actively managed bond fund (DODIX) versus an similar index fund (VBMFX). Both are high quality intermediate funds. The 10-year return of DODIX (exp ratio 0.43%) is 0.86% higher than VBMFX (exp ratio 0.22%). When financial research companies show 10 year returns (example image below), does the return include the amount deducted from expense ratios? If that is the case, would the yield advantage of DODIX be the entire 0.86%? Or do expense ratios need to be considered resulting in a DODIX yield advantage of 0.65% (0.86% -0.43% + 0.22%)? Thanks