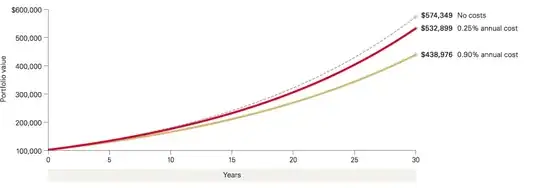

You absolutely should consider expenses.

Why do they matter when the "sticker price" already includes them? Because you can be much more certain about what the expense ratio will be in the future than you can about what the fund performance will be in the future.

The "sticker price" mixes generalized economic growth (i.e., gains you could have gotten from other funds) with gains specific to the fund, but the expense ratio is completely fund-specific. In other words, when looking at the "sticker price" performance of a fund, it's difficult to determine how that performance will extend into the future. But the expense ratio will definitely carry into the future. It is rare for funds to drastically change their expense ratios, but common for funds to change their performance.

Suppose you find a fund that has returned a net of 8% over some time period and has a 1% expense ratio, and another fund that has returned a net of 10% but has a 2% expense ratio. So the first fund returned 9%-1% = 8% and the second returned 12%-2%=10%. There are decent odds that, over some future time period, the first fund will return 10%-1%=9% while the second fund will return 10%-2%=8%. In order for the second fund to be better than the first, it has to reliably outperform it by 1%; this is harder than it may sound. Simply put, there is a lot of "noise" in the fund performance, but the expense ratio is "all signal".

Of course, if you find a fund that will reliably return 20% after expenses of 3%, it would probably make sense to choose that over one that returns 10% after expenses of 1%. But "will reliably return" is not the same as "has returned over the past N years", and the difference between the two phrases becomes greater and greater the smaller N is. When you find a fund that seems to have performed staggeringly well over some time period, you should be cautious; there is a good chance that the future holds some regression to the mean, and the fund will not continue to be so stellar.

You may want to take a look at this question which asked about Morningstar fund ratings, which are essentially a measure of past performance. My answer references a study done by Morningstar comparing its own star ratings vs. fund expenses as a predictor of overall results. I'll repeat here the take-home message:

How often did it pay to heed expense ratios? Every time. How often did it pay to heed the star rating? Most of the time, with a few exceptions. How often did the star rating beat expenses as a predictor? Slightly less than half the time, taking into account funds that expired during the time period.

In other words, Morningstar's own study showed that its own star ratings (that is, past fund performance) are not as good at predicting success as simply looking at the expense ratios of the funds.