the whole room basically jumped on me

I really have an issue with this. Someone providing advice should offer data, and guidance. Not bully you or attack you.

You offer 3 choices. And I see intelligent answers advising you against #1. But I don't believe these are the only choices. My 401(k) has an S&P fund, a short term bond fund, and about 8 other choices including foreign, small cap, etc. I may be mistaken, but I thought regulations forced more choices.

From the 2 choices, S&P and short term bond, I can create a stock bond mix to my liking. With respect to the 2 answers here, I agree, 100% might not be wise, but 50% stock may be too little. Moving to such a conservative mix too young, and you'll see lower returns.

I like your plan to shift more conservative as you approach retirement.

Edit - in response to the disclosure of the fees -

1.18% for Aggressive, .96% for Moderate

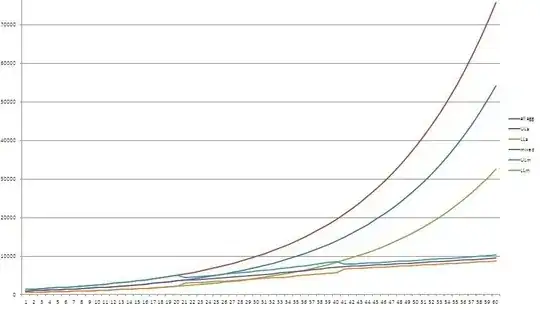

I wrote an article 5 years back, Are you 401(k)o'ed in which I discuss the level of fees that result in my suggestion to not deposit above the match. Clearly, any fee above .90% would quickly erode the average tax benefit one might expect. I also recommend you watch a PBS Frontline episode titled The Retirement Gamble It makes the point as well as I can, if not better.

The benefit of a 401(k) aside from the match (which you should never pass up) is the ability to take advantage of the difference in your marginal tax rate at retirement vs when earned. For the typical taxpayer, this means working and taking those deposits at the 25% bracket, and in retirement, withdrawing at 15%. When you invest in a fund with a fee above 1%, you can see it will wipe out the difference over time. An investor can pay .05% for the VOO ETF, paying as much over an investing lifetime, say 50 years, as you will pay in just over 2 years.

They jumped on you? People pushing funds with these fees should be in jail, not offering financial advice.