Background:

- I recently turned 25 and became applicable to invest into my employer's 401K. Due to no matching, I have 3% allocated in as a supplemental retirement fund.

- Currently single, rent (no intentions to buy soon), and have a stable job that isn't planned to change in the next few years.

- I have a recent car loan (5 years - 2.89%) and some student loans remaining (~7 years - about 6%). I fully understand the urgency to pay these off in far less time and will be capable of doing so even with these retirement accounts.

- Very little to no experience in terms of investing. Highly logical and can do the math, but terminology and best approaches are new to me.

Vanguard:

After reading through a few dozen threads on Vanguard, it sounds like they're up there on one of the best hands-off retirement accounts. It seems like I could open a Roth IRA with them and set a Target Retirement Fund and be done. I plan on maxing my Roth IRA yearly, so I know starting early is the best way to do so. The problem is knowing if this is considered too good to be true.

Advisor:

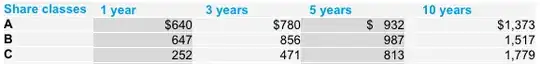

I went to a financial advisor through a nearby bank (services a few states). He suggested setting up a mutual fund with American Funds and that would probably return 7% over the long run. He went through charts/data and such, but all I could pull in was yearly percentages since that's all I know. I understood any ups and downs and how they're all a part of the end goal on hitting a 'good' average. Ultimately, it just felt like everything he said was generic and wasn't more than their 'filler' suggestions.

Questions:

- Between Vanguard and the advisor, are there any concerns with choosing one over the other?

- Wouldn't Vanguard (or other online ones (Fidelity?)) be a better approach because of its background and the fact that the advisor doesn't (?) gain anything if my money does well or not?

I'm simply trying to see if that 'free' advisor would be beneficial at all. There's probably a good reason why he never was like "Have you looked into online Roth IRAs?"

Personal follow-up:

I sincerely appreciate every bit of advice that has been provided over the past few days. I've decided to lock into a Vanguard Roth IRA and shut down communication with the advisor I talked with. The Internet is a wonderful place where one's 'basic' advice can help shape another's future. Thank you, greatly!