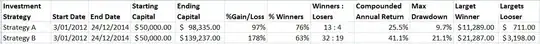

I have been back-testing some share investment strategies for my SMSF (self managed retirement fund) and have narrowed it down to two strategies that have consistently performed the best over a 3 year period. A summary of the two strategies is summarised in the table below:

The starting capital for both strategies is $50,000 and the chosen strategy would only form a portion of the total investments in the fund which would also include some direct property investments, some cash and possibly some bonds.

Strategy A had a Compounded Annual Return (CAR) of 25.5% and almost doubled the initial investment in 3 years compared to a whopping CAR of 41.1% for Strategy B which almost tripled the initial investment over the same period. Looking simply at this information it seems like a no brainer to choose Strategy B. However, being a retirement fund, would it still be wise to choose Strategy B over Strategy A?

Notes Regarding the Strategies: In the back-testing for both strategies all trades where bought at the open on the next day once a signal was given and a 20% trailing stop loss was automatically placed on each open trade. I also plan to test both of these strategies going forward over the next 12 months in a virtual account to verify the results and avoid curve fitting the back-tested results. Once this is done and the results are confirmed I could start trading a real account in either 2016 or 2017 (depending on when I set up my SMSF), so if the results do not correspond to the back-testing I still have a further year available for additional planning.