It is very likely that the fund paid out a dividend in the form of reinvested shares. This happens with many funds, especially as we come to the end of the year.

Here's a simplified example of how it works. Assume you invested $1000 and bought 100 units at $10/unit. Ignoring the daily price fluctuations, if the fund paid out a 20% dividend, you would get $200 and the unit price would drop to $8/unit. Assuming you chose to reinvest your dividends, you would automatically purchase another $200 worth of units at the new price (so 25 more units). You would now have 125 units @ $8/unit = $1000 invested.

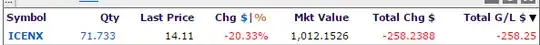

In your example, notice that you now have more shares than you originally purchased, but that the price dropped significantly. Your market value is above what you originally invested, so there was probably also a bit of a price increase for the day. You should see the dividend transaction listed somewhere in your account.

Just to confirm, I did a quick search on ICENX and found that they did indeed pay a dividend yesterday.