The long term view you are referring to would be over 30 to 40 years (i.e. your working life). Yes in general you should be going for higher growth options when you are young. As you approach retirement you may change to a more balanced or capital guaranteed option.

As the higher growth options will have a larger proportion of funds invested into higher growth assets like shares and property, they will be affected by market movements in these asset classes. So when there is a market crash like with the GFC in 2007/2008 and share prices drop by 40% to 50%, then this will have an effect on your superannuation returns for that year. I would say that if your fund was invested mainly in the Australian stock market over the last 7 years your returns would still be lower than what they were in mid-2007, due to the stock market falls in late 2007 and early 2008. This would mean that for the 7 year time frame your returns would be lower than a balanced or capital guaranteed fund where a majority of funds are invested in bonds and other fixed interest products.

However, I would say that for the 5 and possibly the 10 year time frames the returns of the high growth options should have outperformed the balanced and capital guaranteed options.

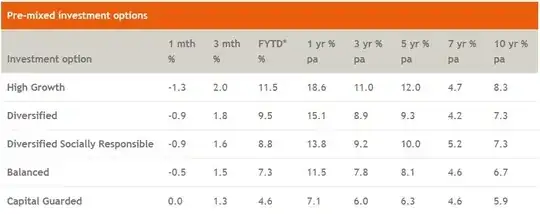

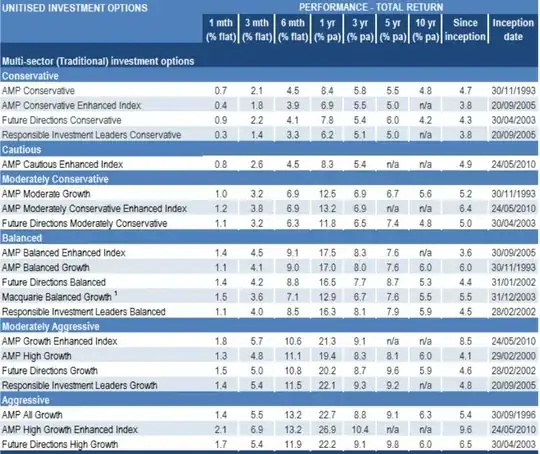

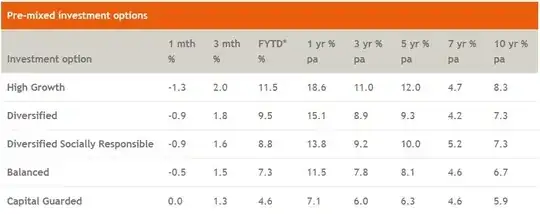

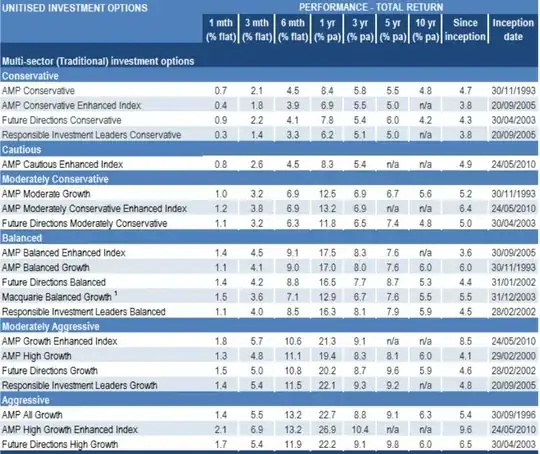

See examples below:

First State Super

AMP Super

Both of these examples show that over a 5 year period or less the more aggressive or high growth options performed better than the more conservative options, and over the 7 year period for First State Super the high growth option performed similar to the more conservative option.

Maybe you have been looking at funds with higher fees so in good times when the fund performs well the returns are reduced by excessive fees and when the fund performs badly in not so good time the performance is even worse as the fees are still excessive. Maybe look at industry type funds or retail funds that charge much smaller fees.

Also, if a fund has relatively low returns during a period when the market is booming, maybe this is not a good fund to choose. Conversely, it the fund doesn't perform too badly when the market has just crashed, may be it is worth further investigating. You should always try to compare the performance to the market in general and other similar funds.

Remember, super should be looked at over a 30 to 40 year time frame, and it is a good idea to get interested in how your fund is performing from an early age, instead of worrying about it only a few years before retirement.