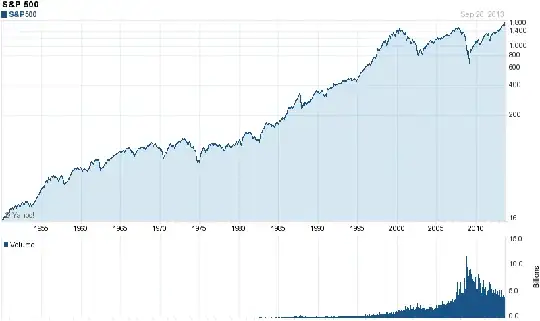

I have some money I intend to invest over the next 3-4 years. An important chunk of my portfolio would be invested in a stock market index ETF such as one representing the S&P 500. Unfortunately, the S&P 500 has hit all-time highs recently.

I wouldn't be buying a big chunk now, but investing monthly over the next 3-4 years, so if the market were to crash tomorrow (or at some point during that period) I'm reasoning it wouldn't be that bad. I've run some simulations and this strategy seems to work, but I'm unconvinced.

Under this kind of scenario, would it make sense to buy anyway?

The alternative I'm considering is buying bonds and just waiting until the next crash to buy. I'd be missing on the returns from now until the crash (that may take a loooong time to come) but I'd be getting some returns for low risk and essentially buying time. OTOH, that sounds like market timing, and everything I read is against trying to time the market (and I agree).

Any insights to break the mental knot I got myself into?