The study of technical analysis is generally used (sometimes successfully) to time the markets.

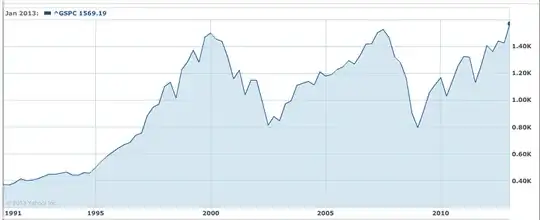

There are many aspects to technical analysis, but the simplest form is to look for uptrends and downtrends in the charts. Generally higher highs and higher lows is considered an uptrend.

And lower lows and lower highs is considered a downtrend.

A trend follower would go with the trend, for example see a dip to the trend-line and buy on the rebound.

Whilst a bottom fisher would wait until a break in the downtrend line and buy after confirmation of a higher high (as this could be the start of a new uptrend).

There are many more strategies dealing with the study of technical analysis, and if you are interested you would need to find and learn about ones that suit your investment styles and your appetite for risk.