I was talking to a hotel and to reserve a room, they asked for my credit card details.

It was not a payment via a secure link like online shopping (where I even get an app notification to authorise a specific amount which is shown in the notification that I authorise).

But the hotel asked the following details on an email

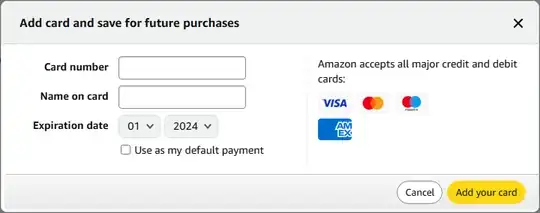

- Card Number (it's a master card)

- My name

- Expiry date

Surprisingly, they did not ask for CVC, and I did not give it either. But nonetheless, after about a week, I got a message from my bank that my account has been charged with the amount (in a foreign currency, where the hotel is located).

This transaction in itself is legit, but it got me thinking, is it that easy to charge a card without even knowing the CVC and an app notification for me to authorise it?

How does it work behind the scene? Does it mean my bank will give the money to anyone who comes to it with the credit card number? Or, did the hotel operator forward my credit card details to its own bank, which came to my bank get the money? How does either bank verify the amount, or whether subsequent transactions are authorised from the same card? Is it purely a matter of trusting that merchant?

If the details matter, my bank is

- DBS (a Singapore bank)

- the merchant is Hilton Hong Kong

But I suppose the rules should be agnostic to these details?