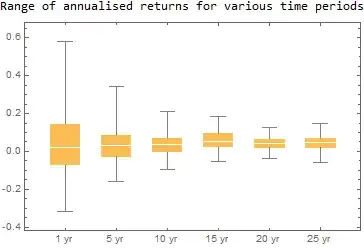

Here is a simple model which produces a similar chart. Each box-and-whisker simulates 100 investments returning anything between 9% and -8% per month, compounded and annualised. The upper & lower fences show the maximum and minimum investments' return.

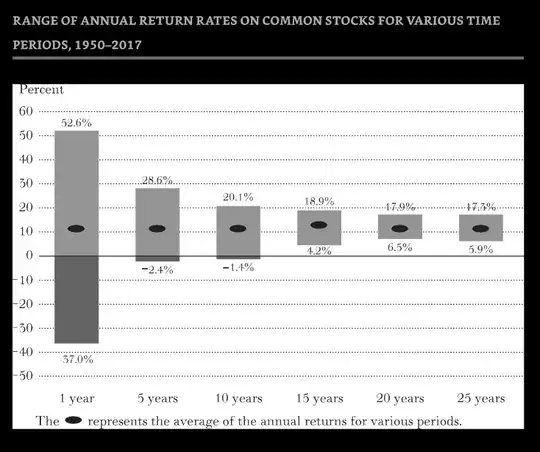

Generally the chart shows the volatility of return reducing for longer investments.

OP: "Does that mean holding a particular security for a longer period of time would reduce one's risk while providing the return attributed to high risk?"

Risk is quoted for a specific time period for comparison purposes, but yes, risk (or volatility) does settle down for longer investment periods. The mean return is basically the same for all the time periods in this example, but if the volatility is higher there is a higher chance of a return further away from the mean, either higher or lower.

The chart above was produced with the Mathematica code below.

{hi,lo}={9,-8};

Labeled[BoxWhiskerChart[{

Table[(Fold[Times,100,RandomReal[{hi,lo},12]/100+1]/100)^(1/1)-1,100],

Table[(Fold[Times,100,RandomReal[{hi,lo},60]/100+1]/100)^(1/5)-1,100],

Table[(Fold[Times,100,RandomReal[{hi,lo},120]/100+1]/100)^(1/10)-1,100],

Table[(Fold[Times,100,RandomReal[{hi,lo},180]/100+1]/100)^(1/15)-1,100],

Table[(Fold[Times,100,RandomReal[{hi,lo},240]/100+1]/100)^(1/20)-1,100],

Table[(Fold[Times,100,RandomReal[{hi,lo},300]/100+1]/100)^(1/25)-1,100]},

ChartLabels->{"1 yr","5 yr","10 yr","15 yr","20 yr","25 yr"}],

"Range of annualised returns for various time periods",Top]

To explain, RandomReal produces random numbers (60 of them in the 5 year case)

RandomReal[{hi, lo}, 60]/100 + 1 = {1.06035, 1.03478, ... , 0.991715}

Fold compounds the values starting from 100

Fold[Times, 100, {1.06035, 1.03478, ... , 0.991715}] = 163.174

This result is annualised

(163.174/100)^(1/5) - 1 = 0.102885 = 10.2885% return p.a.

Table[...,100] repeats the 5 year investment simulation 100 times.

From the 100 5 year returns obtained, the highest and lowest returns are plotted as the upper & lower fences of the "5 yr" box-and-whisker symbol.