The joke contrasts a low risk investment strategy with an extremely high risk strategy. The modern equivalent would be "He leveraged his ass deep into Bitcoin and GameStop futures."

The low risk strategy:

- periodic investment: he added new money several times, rather than all at once. This could be viewed as a form of dollar cost averaging which is less popular now but was probably in vogue in the 70s.

- no-load: "mutual fund in which shares are sold without a commission or sales charge" - i.e., low fees for the investor.

- mutual fund: "Mutual funds are pooled investments managed by professional money managers." In the 70s, they were presumably more diversified (reducing risk) and level-headed (not selling during a crash) than an average individual retail investor. (NB: The first passive mutual fund was invented in 1976.)

The high-risk strategy:

- Leverage: He borrowed money from the bank or brokerage to invest more money than he had. If the market goes up, he would make more money than he could have. But if the investment went down, he'd be on the hook for even more money beyond the original cash he put in.

- Soy beans: Soy beans were volatile for decades before the film. From 1960-61 they had an approximate 60% ROI. They spiked and crashed around 40% at least 3 times in each direction in the decade before the film.

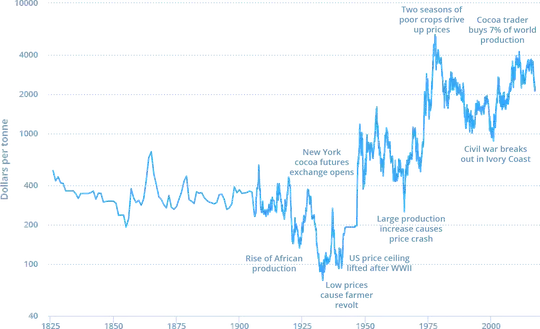

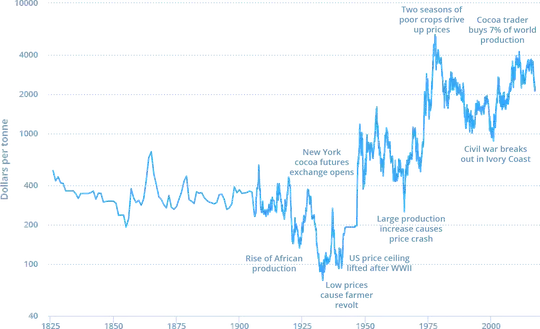

- Cocoa: Cocoa apparently had around a 900% ROI in the 1970s. I can't find data before 1990, but data since 1990 is somewhat volatile as well.

- Futures: the wording is ambiguous, but the investor had cocoa futures and possibly soy bean futures as well. "Futures are contracts to buy or sell a specific underlying asset at a future date." Futures are more risky than their underlying asset - in this case, soy beans and cocoa. Unlike stocks, futures are settled in physical items - so this investor could find themself forced to take delivery on thousands of overpriced containers of soy beans and cocoa.