Wait, using that page, it makes a great deal of difference what years you put the numbers in. So when you say "work 25 years", for example, are you entering numbers from 1990 to 2014, or from 1995 to 2019, or ... when? Because the numbers for each year are adjusted for inflation. So putting them in starting at 1950 gives you 50 more years of inflation than starting at 2000.

Just for example, I tried entering $200,000 each year from 1976 to 1985 and it said the benefit would be $1640. But enter $200,000 each year from 1977 to 1986 and the benefit drops to $1194.

So whatever you did to come up with the numbers you gave may or may not be meaningful.

So let's go back to the formula. Here's what matters:

- Benefits are based on your highest-earning 35 years, after adjusting for inflation. If you work less than 35 years, they average in enough zeros to make the total 35. Only income up to the maximum taxable amount counts, so entering $200,000 for every year, most of that is not going to enter into the calculation.

But just for example, if you earned $20,000 every year after adjusting for inflation and you worked for 35 years, then your average income for that 35 years is $20,000. (Duh.) If you only worked 25 years, then they're going to take ( 25 x $20,000 + 10 x $0 ) / 35 = $14,286.

So in the first case your benefit will be based on $20,000, i.e. $1180 per month by my calculation. In the second case it will be based on $14,286, or $1027.

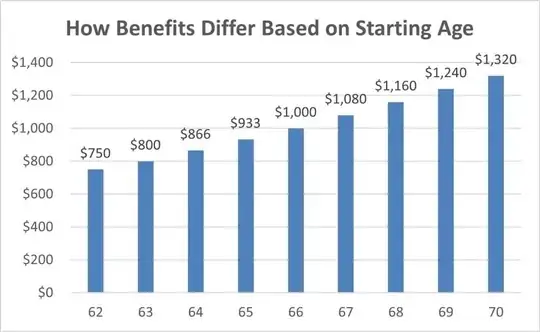

- Benefits are reduced if you retire early. If you retire at full retirement age, which is 67 for people born 1960 or later, you can the "basic" benefit. If you retire earlier than that, they reduce your benefit by 5/9 of 1% for every month before 67, up to 36 months, and then by 5/12 of 1% for every month after that. Earliest possible retirement is age 62.

So if you retire at 64, that's 3 years or 36 months early. Your benefit would be reduced by 36 x 5/9% = 20%. If you retire at 62, that's 5 years or 60 months early, your benefit would be reduced by 36 x 5/9% + 24 x 5/12% = 20% + 10% = 30%.

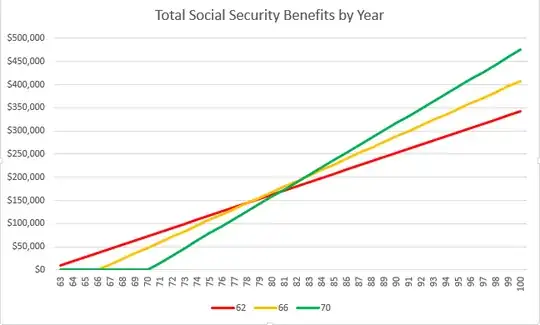

So calculating how much benefit you would get by working fewer years versus retiring early means comparing averaging in more zero years versus increasing the number of months of reduction.

If you're calculating using the same number for every year, I presume you're not considering inflation. So fine, let's just ignore inflation. Theoretically, at least, as social security is adjusted for inflation, any inflation between now and when you retire should cancel out.

Oh, and the benefit formula is 90% of the first $1115 of average monthly earnings, 32% of earning from 1115 to 6721, and 15% above that (up to the maximum taxable amount).

So to take your first example, a more meaningful computation is:

25 years @ 160,000 and retire at 62

Average income is (25 x 160,000 + 10 x 0) / 35 = 114,285

114,285/year = 9,524/month

Basic benefit = .9 x 1115 + .32 x (6721-1115) + .15 x (9524-6721) = $3217

Retire 5 years early means reduce by 30% gives $2252

Basically, working 35 years instead of 25 years will increase your benefits by 41%. Working until 67 instead of 62 will increase your benefits by 43%. Whether either or both are worth it depends on your personal financial situation, and your desire to work less or retire earlier versus how much money you want to receive in retirement.