It doesn't matter (especially with the ACST cost basis calculation). It would matter if it was inheritance. Given that you said it's a gift - it doesn't.

For ACST, the fund divides the total amount invested by the total shares held, and that's the cost basis for your sale transaction. It's recalculated (for the whole holding) every time you make a new purchase. See the IRS Pub 550.

Gifted property retains the original tax basis, and the fund averages the cost bases, so it doesn't matter to you for the purpose of capital gains calculation whether it was part of the original gift from your father or the subsequent purchase you made yourself - it's all bundled together in the same average.

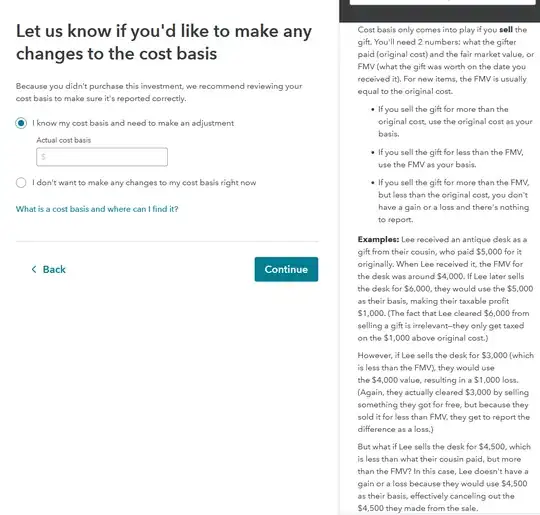

Your additional screenshot shows that in some cases it does in fact matter, if you can track it correctly.

Here's the thing: FMV (fair market value) at the time of transfer may affect how the gain/loss is calculated, as described in the screenshot.

To be able to take it into account though you'd need to recalculate the ACST cost basis using the FMV instead of the original purchase price for the gifted shares. For that, you'll need to know how many shares were in fact gifted, and their value on the day of transfer (if you know the first, you can contact the fund for the second). You'll then add all the additional shares you've purchased over time and their prices and average it all into a new ACST value that you'd need to fill on this screen.

If the sale price is more than the original cost, then this whole exercise would be a complete waste of time. Without knowing the details of the fund, I'm guessing that after 15 years it is likely not being at a loss from the original purchase.

Given that you're talking about gains, your sale price is more than the original cost (using ACST). So in this case it still doesn't matter and you can safely select the second option.