If US Treasuries at yielding 4-5% right now, why can't I find a 1 month US Bond ETF or 6 month US Bond ETF that yields 4-5%? The best I can find is SGOV but it only yields 2%.

Asked

Active

Viewed 5,890 times

24

Chris W. Rea

- 31,999

- 17

- 103

- 191

Katsu

- 525

- 4

- 11

3 Answers

12

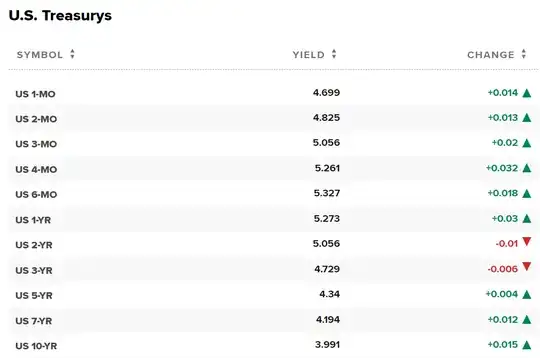

The average yield to maturity of SGOV is 4.41%. The 2% is the 12-month trailing yield. From https://www.ishares.com/us/products/314116/ishares-0-3-month-treasury-bond-etf:

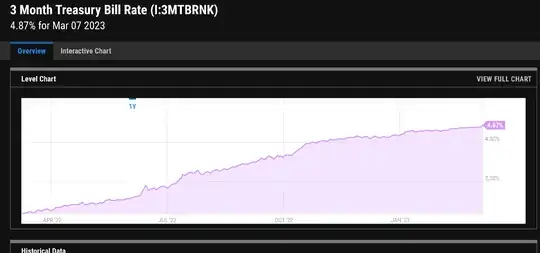

Note that the average yield to maturity of SGOV is a bit lower than newly issued Treasury bills, as the yield to maturity has been increasing steadily over the past 1 year. From https://ycharts.com/indicators/3_month_t_bill:

Franck Dernoncourt

- 11,883

- 13

- 60

- 147

0

If you're trying to immediately capitalize on higher rates, your best bet might actually be a money-market mutual fund in the current environment. These funds have access to the Fed's Overnight Reverse Repo ("ONRRP") facility for parking their excess cash, and as of the most recent rate hike, the ONRRP facility is paying 5.30%.

user68318

- 374

- 1

- 10