I have a series of RSU + ESPP sales within the past calendar year. All RSU and ESPP that have vested and been awarded have been reported as ordinary income via a W2. My company uses ETrade for distributing RSU and ESPP shares. On the "Stock Plan Transactions Supplement" ETrade provides, I get columns Total Proceeds, Adjusted Cost Basis, and Adjusted Gain (Loss). I am under the impression that the sum of Adjusted Gain (Loss) (Adjusted Gain (Loss) is the difference between Total Proceeds and Adjusted Cost Basis) for all my sales constitute the total short and long term capital gains or losses related to my RSU and ESPP transactions. Is this correct?

3 Answers

Yes, gains and losses from RSU and ESPP sales go on Form 8949.

Make sure the cost basis reported is accurate. Sometimes, the 1099-B for equity compensation doesn't report the correct basis. The supplement provided should be accurate.

Your cost basis for RSUs is the price on the vesting date (usually the adjusted close price).

For ESPP shares (assuming a qualified plan), your cost basis is generally either the price on the grant date (if the sale is more than 2 years after grant AND more than 1 year after purchase) or the price on the purchase date (if the sale is 2 years or less after grant OR 1 year or less after purchase).

The purchase discount amount (if any) for ESPP shares is ordinary income and should already be included in your W-2 as income (do not include that portion on Form 8949).

All cost bases are adjusted by commissions and other costs to acquire the shares.

As long as the numbers are correct, Total Proceeds - Adjusted Cost Basis = Gain/(Loss) (On Form 8949: d - e = h). If the basis is incorrect, you may need to adjust it by using boxes f and g on Form 8949.

Your net short-term gain/(loss) + net long-term gain/(loss) is your total net gain/(loss).

- 7,956

- 1

- 19

- 37

Do RSU / ESPP Sales Go On Form 8949 As Capital Gains And Losses?

Yes. The "Stock Plan Transactions Supplement" on https://us.etrade.com/etx/pxy/tax-center contains the proper cost basis (unlike Form 1099-B, which says 0 USD for RSUs).

FYI:

- Why is the cost basis reported by a broker on RSUs 0 USD?

- Reporting RSU on Turbotax

- Must I select "The cost basis is incorrect or missing on my 1099‑B" in TurboTax in the case of vested RSUs?

the sum of Adjusted Gain (Loss) (= Total Proceeds - Adjusted Cost Basis) for all my sales constitute the total short and long term capital gains or losses related to my RSU and ESPP transactions. Is this correct?

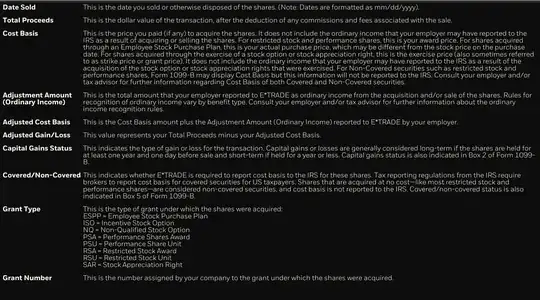

Yes. Note that the "Stock Plan Transactions Supplement" explains all the terms:

- 11,883

- 13

- 60

- 147

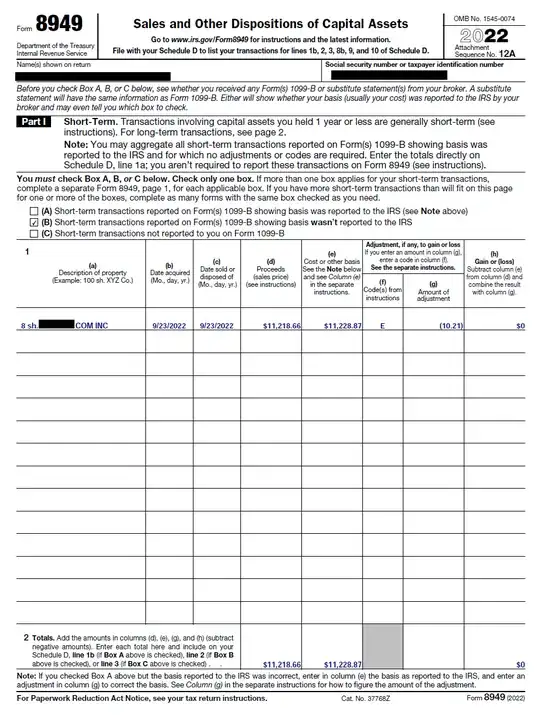

Yes, and here's a sample of one I did myself for tax year 2022.

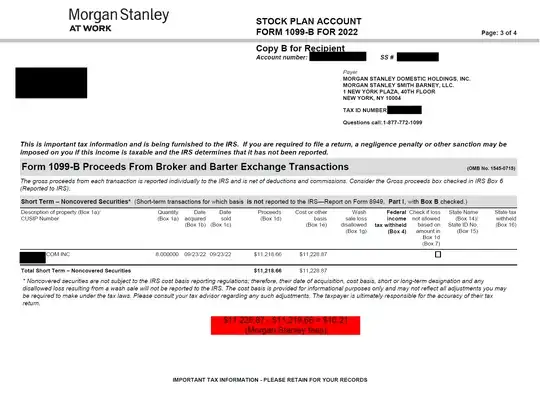

Here's a copy of the 1099-B that enumerates the shares sold to cover taxes at the RSU vesting date.

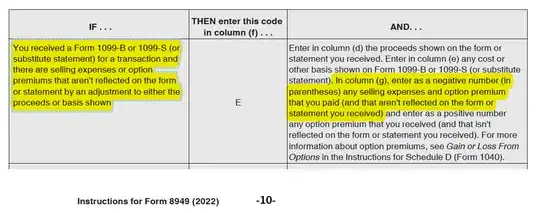

And here's a copy of the Form 8949 that was filled out from that form. Columns (b), (c), (d), and (e) all carry over verbatim from the 1099-B into f8949. Column (a) gets a formatting into the description of the property. Column (g) lists the total fees my brokerage charged which is needed to adjust the cost basis and column (f) details a code that maps to the type of adjustment that was exercised.

In the case for this RSU sales the brokerage charged a fee that needs to be subtracted and hence the number in the parenthesis.

It all balances out to zero capital gains as it should, since in this context the filing of the 8949 isn't really to produce capital gains but to communicate to the IRS the cost basis they wish to confirm from you for those shares that were sold. I'm still hoping to understand this prohibition of the broker to report on your behalf the cost basis but I'm still trying to grok this answer over here https://money.stackexchange.com/a/155654/24838

- 1,957

- 2

- 21

- 31