I file my US taxes via TurboTax as a US lawful permanent resident. Some of my RSUs vested in 2021, which I partly sold in 2021. My employer uses E-Trade for RSUs. E-Trade reports on Form 1099-B that the cost basis for vested RSUs is 0 USD, which is untrue. I can go to https://us.etrade.com/etx/pxy/tax-center and click on Stock Plan Transactions Supplement to view the Adjusted Cost Basis.

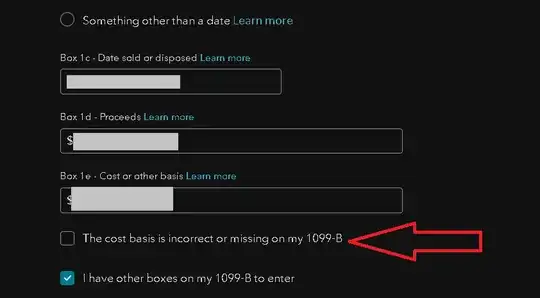

In TurboTax, after reporting in Box 1e - Cost basis the Adjusted Cost Basis, must I check The cost basis is incorrect or missing on my 1099‑B?