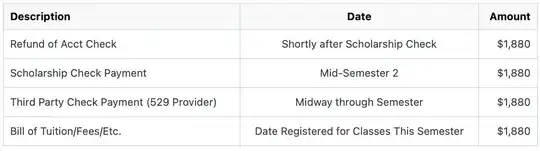

It appears that you paid your tuition, and then the payment was refunded to you because you received a scholarship.

In order for this not to be a disqualified distribution from your 529 fund, you need to re-contribute it to 529 within 60 days of receipt (of the refund).

See the IRS guidance here:

The PATH Act change added a special rule for a beneficiary of a 529 plan, usually a student, who receives a refund of tuition or other qualified education expenses. This can occur when a student drops a class mid-semester. If the beneficiary recontributes the refund to any of his or her 529 plans within 60 days, the refund is tax-free.

The Treasury Department and the IRS intend to issue future regulations simplifying the tax treatment of these transactions. Re-contributions would not count against the plan’s contribution limit.

Also: The IRS Publication 970.

Keep all the documentation, including proofs for the dates of refunds and recontributions, in case of an audit.

You mentioned in the comments that 60 days have passed. That makes it non-qualified distribution. There are still several points to remember:

If you had additional qualified expenses that you paid out of your own pocket - you can allocate that money to them. That makes the allocated portion qualified.

If the scholarship that you received is non-taxable - then the refunded 529 distribution, the non-qualified part of it, is taxable - but there would be no penalty. You only pay taxes on the earnings.

If you don't have any other qualified expenses and you don't qualify for the tax-free scholarship exception or any of the other exceptions listed in Pub. 970 - you're out of luck, you'll pay taxes on earnings and the 10% penalty.

See details on calculating the taxable portion in the IRS Publication 970, especially the relevant exceptions section:

The 10% additional tax doesn't apply to the following distributions.

...

Included in income because the designated beneficiary received:

- A tax-free scholarship or fellowship grant (see Tax-Free Scholarships and Fellowship Grants in chapter 1);

- Veterans' educational assistance (see Veterans' Benefits in chapter 1);

- Employer-provided educational assistance (see chapter 10); or

- Any other nontaxable (tax-free) payments (other than gifts or inheritances) received as educational assistance.

This exception only applies to the extent the distribution isn't more than the scholarship, allowance, or payment.

...

The taxable income goes on the line 8z of the Schedule 1 for the Form 1040. Use the form 5329 part II to calculate the penalty, and add the result on line 8 of the Schdule 2 for the Form 1040.