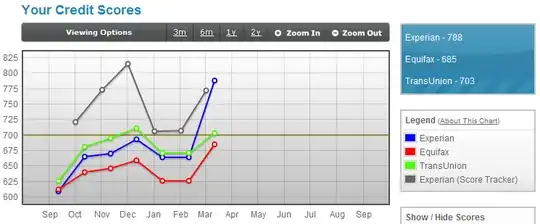

3 months ago, my credit score took a massive dip. The consensus was that this happened because I no longer had any credit cards and thus no revolving debt.

So I went out and got myself a new credit and I made sure that it reported to the credit agencies. This was the result:

Obviously the biggest change is the Experian score. In January, when I didn't have any revolving debt, the Experian score dropped by 30 points. Today, it went up by over a 100. I dutifully compared the January and March credit reports and other than this new credit card, everything is absolutely the same.

The Equifax score is also a bit baffling. It also dropped in January, but went up double the drop in March. Transunion is the most consistent of all - the peaks and valleys are easy to understand.

So, can someone tell me why all these perturbations are happening? Everything I read states that the scores should be predictable.