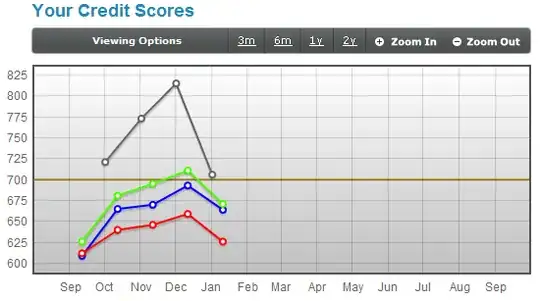

I checked my credit score today and it took a massive dip compared to one month ago:

Ignore the gray line - it's immaterial.

- Transunion - Green

- Experian - Blue

- Equifax - Red

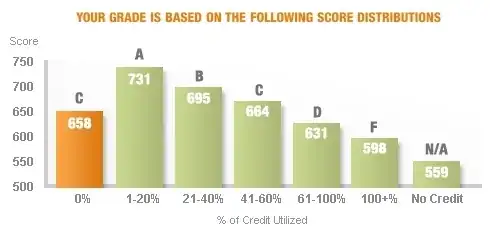

I downloaded the credit report and compared it line by line with the report from last month. They are exactly identical, except for one thing: my revolving debt went from $16 to $0.

Can someone explain why the score would dip like this and whether there is anything I could do.