- "customer tells contractor that she or he can't pay for the job via common overseas payment options..."

FYI. This is, simply, an outright lie.

It would be like saying "I can not purchase a cup of coffee" or "I am unable to find a Road" or "There's a strange problem and the sun didn't rise today."

Completely silly.

(It could be they want to pay with bitcoin, since (say) they have some on hand, but if they say they "can't" pay normally, it's simply a lie.)

- It is trivial to convert bitcoin to ordinary money, sure. This happens in the billions each day.

Here's a trivial example -

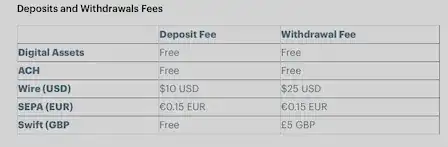

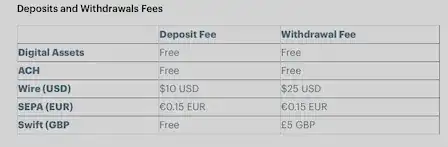

coinbase.com, costs a few dollars to send USD, GBP or EUR.

- Note that in this situation, very simply the >> customer << would simply click one button to send normal USD to the contractor.

There is utterly no reason for the customer, to send bitcoin, and expect the contractor to make the effort to exchange it to dollars.

The >> customer << would simply click one button to send normal USD to the contractor.

(Sure, the customer may say "Oh, I can't be bothered doing that, I will give you 20% extra on top so you can do it." But normally the customer would click one button to exchange bitcoin to USD and send a normal transfer.)

This is simply a scam.

Note that this is almost certainly some sort of scam or scammy edge case.

Anyone who "has bitcoin" knows you can click a button, exchange it to USD, and send a normal dollar transfer to say a contractor or other payment.

This happens in the billions every day and it's as easy as buying panties at WalMart. It's a non-issue, trivial.

The fact that they're saying they "can't" do this instantly flags it as some sort of scam or soft scammy edge case.

Do note that if you accept bitcoin in payment, you MUST tell the IRS about the transaction, there is a special form.