I was casually reading the 10K for 2019 for Apple where I realized that I don't get the numbers.

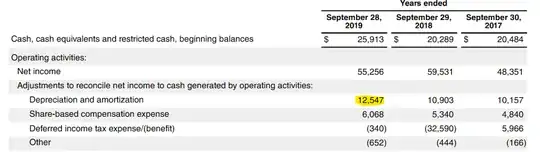

In the consolidated statement of cash flows (page 36) "Depreciation and amortization" for 2019 is stated as 12,547 billion USD.

But later on page 38 the "Property, Plant and Equipment" states:

Depreciation and amortization expense on property and equipment was $11.3 billion, $9.3 billion and $8.2 billion during 2019, 2018 and 2017, respectively.

I am missing how those two numbers are connected and what the true depreciation value for a formal income statement actually is.

Bonus question: When browsing common stock sites that display income statements, depreciation is rarely to be seen. Isn't it a mandatory part of a formal income statement and should be displayed for completeness?