How can I determine a fixed payment amount for a loan that has an early first payment?

Example:

Loan Amount: $100

Interest: 10%

Loan Date: January 1st, 2018

First Payment Date: January 15th, 2018

Term: 10 Years, payments made yearly on January 15th

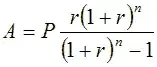

Normally I'd use the Amortization Payment Formula below, but in this case it doesn't seem to work. My guess is that P needs to be adjusted to be somewhat less, but it's not clear how to calculate that.