New investor here, using the Robinhood platform. I quickly learned that placing market orders never really nets you what the app indicates; limit buys and sells fix that. Typically, I assume, limit sell orders fill at the moment a stock's price hits your limit while on an upswing, but I also thought it must be possible to fill a limit sell at a higher price if the market opens higher than that limit. Indeed, I've noticed that when placing a limit order the app tells me my stock will be sold at my limit price or better.

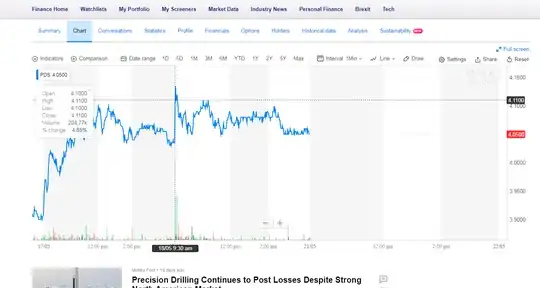

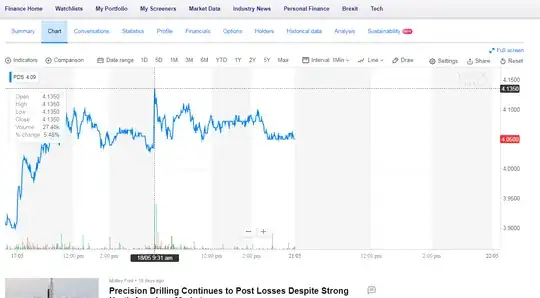

Today I see that my pending limit sell order for PDS at $4.11/share executed at $4.11/share, but the market opened at $4.13 per share, and it was even higher in pre-market.

So my question is, why didn't I get credited at the $4.13 price?

https://www.google.com/search?tbm=fin&q=PDS

PDS price chart, cursor shows price at market open on May 18