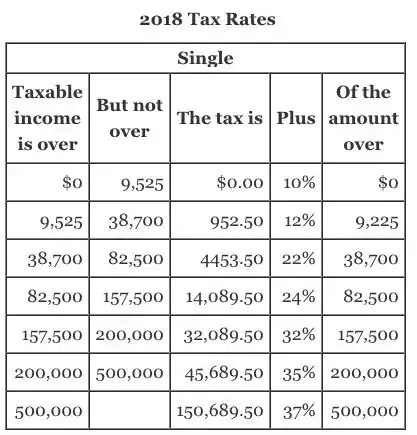

Remember when contributing, it's the incremental tax bracket (the tax on your next dollar) that matters. Dividing your AGI by your tax will mislead you.

Roth allows you to invest more money

You are trying to model IRAs with an arbitrary $100, but that presumes unlimited contributions are possible. Real world you have contribution limits.

Joe earns an extra $5500. He puts it into a traditional IRA. His IRA grows to $55,000, and after paying your 20% bracket, he gets $44,000 out.

Tom earns an extra $6875. He pays $1375 of taxes on it in your bracket, leaving $5500. He puts it in a Roth IRA. His Roth grows to $55,000, and after paying ZERO TAX, he gets $55,000 out.

I can hear your objection now: "The ratio is the same! 44000/5500 = 55000/6875! = 8/1" -- True.

But Tom was able to save 25% more for retirement using the Roth instead of IRA.

The difference is much more extreme when using real world numbers like 28% Fed/11% Calif, where now the difference is 39% instead of your 20%. Run the numbers in a 39% bracket, but I get "64% more", might've flubbed something up.

But tax brackets are not fixed!

Let's talk a third case: Chuck. Chuck earns an extra $5500. He puts it in a traditional IRA. His IRA grows to $6000 to make the numbers round.

Chuck has a "gap year" where he takes the year off. He converts his IRA to a Roth. His effective tax bracket is 5% (splitting the 0-10% brackets) so he has to pay $300 out-of-pocket. This tax does not come out of the IRA money, so full value transfers into the Roth, now worth $6000. The usual appreciation continues, and he finishes with a Roth worth $55,000, pays zero tax, and gets $55,000 out.

Note that 55000/5800 is considerably better than 8/1. How??? Chuck scored the "best of both worlds" because he gamed the tax brackets for all they're worth. I've done exactly this. It works.

You can't armwave tax brackets. They matter.

Roth contributions can be withdrawn right away

I realize it is 2018, and "emergency funds" are passé. However I for one still believe in them. All the money you have contributed to a Roth, you can make a one-time withdrawal without penalty. (it cannot be replaced, you set your retirement back if you do this).

This means your Roth can serve as part of your "emergency fund", liberating cash for other purposes.

People who believe in emergency funds have rules about what they consider "valid money". They do not like money invested in the stock market, because the market can fall dramatically, and since stock downturns often coincide with recessions in general, this is most likely when you are laid off and struggle to find work. As such, it's generally considered foolhardy to consider stocks as part of your emergency fund. Now, I'm not quite that extreme. I say you can consider stocks, but you must derate their value by 50-67% to account for their loss of value in a serious downturn.

So the $22,000 you have put in the Roth over the past 4 years, now worth $30,000 because of market growth. You are legally allowed to withdraw $22,000 of that (irrevocably: you can't put it back). But by my logic, I count less than $30,000 (and even less than $20,000) as usable -- 100% of the money in cash positions, maybe 80% of the money in bonds, and 33-50% of the money in stocks. That might total out to $15,000 of "trustable money" you could count toward emergency fund.

But still, $15,000 isn't nothing! It allows you to reduce the rest of your emergency fund by that much.

It would be a shame to withdraw money from a Roth since it is so very, very productive - and a double shame to do it during an economic downturn. But if it's that or feeding your family, at least you have a choice.