My employer includes the bonus given as RSU on the W-2.

How to correctly import the data from E*Trade (who manages the RSU and provides tax forms) into turbo tax (or any other tax software) so it does not get double counted ?

The tax election for RSUs is Sell to Cover which means at vesting a certain amount of the stocks will be sold to pay taxes.

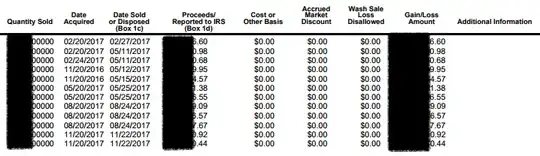

This is how E*Trade lists transactions

2017 FORM 1099−B: PROCEEDS FROM BROKER AND BARTER EXCHANGE TRANSACTIONS

In this list there are both transactions that are Sell to Cover and stock sales I actually made. The cost as you may see is 0 everywhere.