This is probably a very dumb question but I don't get it.

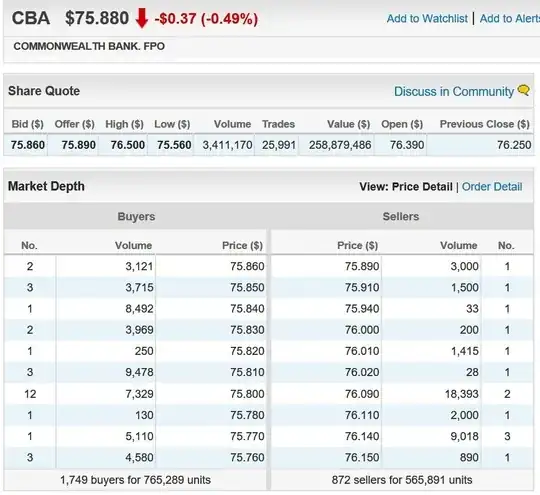

Usually people say if there are more buyers then the price goes up, and if there are more sellers it goes down. Why is that? And in which situation you have a different number of sellers/buyers? I thought for every seller there is a buyer right?

Regarding to the price, I read the market price is the price of the last "transaction". But how is made that transaction?

Example:

If the price is $100, and I buy it at price market (I don't understand who is the seller/buyer on instant orders by the way...), then the last transaction will be $100, we don't move it.

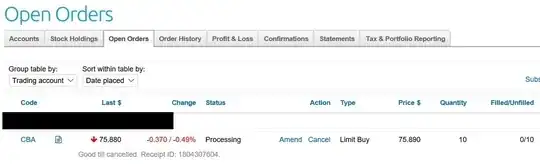

If we put a limit buy order, we need to put it below $100, let's say $99. And the limit sell must be higher, let's say $101. So who is moving the price to $99 or $101? if nobody can sell the stock at $99 or buy it at $101 because the market rules?

Can somebody put a simple example to make me understand why and how the market prices changes?

EDIT (SOLUTION):

There isn't a thing like "market price" there are always two market prices, highest bid and the lowest ask on the order book, those are the prices for market orders, and the last transaction prices means nothing, just a reference.