EDIT : So, I also opened a thread in Topcoder's Forum and I filled the "Reference number" field as "-" and in the tax treaty section, I just filled my country and all the other boxes were filled with "-". I've successfully received the full amount. Hope this helps someone going through the same issue.

I'm from India and I'm a student currently. I recently joined Topcoder (online programming challenges basically) and was filling the payment method section. So, I came across their terms and all and they need me to fill W-8BEN form. Now, I'm kind of confused about how to fill the form.

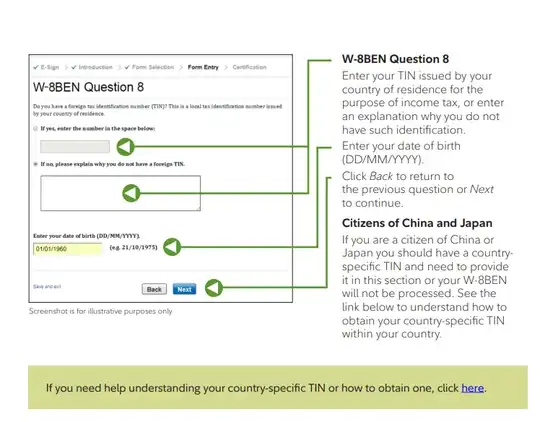

I've got the basic things down like name, DOB and address. But, I'm stuck on 2 things.

There is this column for "Reference Number". I'm not sure what should I fill in this section. Where can I get the Reference Number? Is it my bank account number?

And at last, there is the Tax Treaty Benefits section. I'm a student and I'm a India citizen, living in India.

These are all required fields and I am not sure how to fill these.

I know that there's DTAA signed between India and USA. Meaning that I won't be taxed in USA, but in India. So, whatever money I win from Topcoder, they'll send me the full money and then I'll tax it in India.

I'm confused about just 2 things, i.e., the "reference number" box and the "tax treaty benefits" section.

Here's the form : https://www.scribd.com/document/369719360/TopCoder-Member-Tax-Form-W-8BEN

I'm not sure what article and paragraph of the DTAA treaty is applicable and what would be the % of withholding and what type of income should I specify there.