I have a small start-up business in the US and I'm going through freelance sites like freelancer.com to get some work done. The appeal of this is that the rates for foreign contractors is often less than US contractors, but even so I'm riding the income/expense line pretty closely.

I believe if they were US based contractors I would need to send them a form to do my own deduction. But they are foreign workers and I don't believe they care enough about the US tax system or myself to go through that processes- why would they?

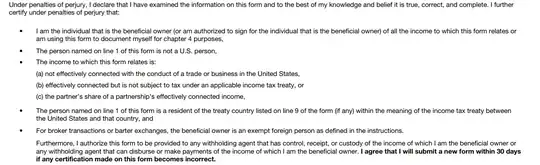

Is there a foreign worker form I should be using?

If the foreign worker does not submit the form, can I still deduct their services?

Would I be in big trouble if I just deducted these expenses without sending any forms out?