Before getting into a practical example, I think it would be valuable to define what "risk" actually is.

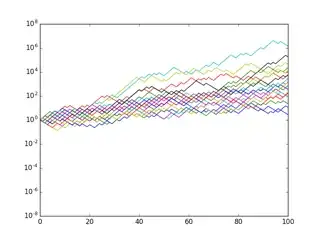

Risk is by definition the magnitude of variance in possible results. When you put $1k in the bank, there is zero risk. You know that the money will be there tomorrow. When you put $1k on the stock market, there is some risk. Tomorrow, you might have .5% more, or 1% less, or 2% more, or the same amount. When you bet $1k on a horse race, there is an insane amount of risk - you might get $5k back, or you might lose it all. What we inherently consider risky, is fundamentally this: the chance that an outcome will vary substantially between many possible results.

The more different a 'good' outcome is from a 'bad' outcome, the riskier it is.

Consider risk through the lens of gambling: I'll offer you 3 bets costing you $1,000 on a fair coinflip, all with the same average payout, and you tell me whether they are all truly identical:

If you win you get $1,100; if you lose you get $900 back.

- Average value of each bet: $1,000.

- Risk: relatively low.

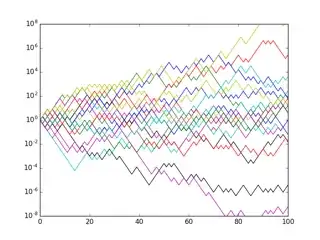

If you win you get $2,000; if you lose you get nothing.

- Average value of each bet: $1,000.

- Risk: High.

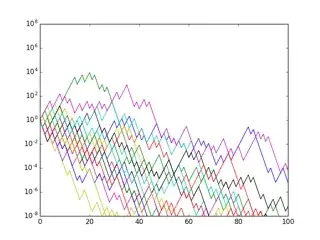

If you win you get $4,000; if you lose you owe me an extra $2,000.

- Average value of each bet: $1,000.

- Risk: Extremely High.

Remember - with our definition of Risk above, we can see that option 1 is the lowest risk, because both success and failure have results that are quite close together. Similarly, option 3 is incredibly high risk, because the positive and negative results are 6x your original bet apart from each other.

These are extreme examples, but they illustrate the differences of options available in the market. All investments in an efficient market theoretically have 'fair' payouts that appropriately compensate for risk. If you want to quibble over details, then bet 2 should actually pay you something like $2,050 on a win to compensate you for the extra risk, and bet 3 should actually pay you something like $4,200, to compensate you for extreme risk.

Still, it is not fair to say that the most extreme risk is always 'best'. What is best depends on your short and long term financial goals, and your ability to withstand a downturn. For example, if you are going to buy a house next year, then high risk is bad, because the market could fall before you need to make a down payment. Similarly, if you have a lot of cash to invest, it might be prudent to consider high-risk investments for a portion of your money, to capitalize on the fact that you can earn higher returns on average, while still being able to afford rent if the market collapses.

Now you might say 'I can afford to lose $1,000; I should take the most extremely risk bet, because it pays more on average'. And that's the point: in this case, you can afford to lose that money. If I told you instead, that the cost of the bet was $100,000, it wouldn't be so easy to choose bet number 2 or 3, would it?