Is there an indicator for the volatility of a stock? When I say indicator I mean like P/E ration, book value etc. If yes, where can I find it? I follow yahoo finance by the way.

3 Answers

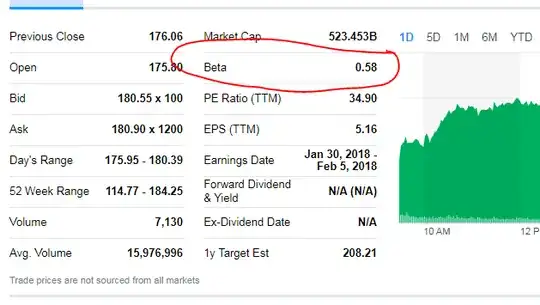

Beta is the measure of volatility and typically available on most stock and often mutual funds information pages.

For a full explanation of Beta

The chart for FB on yahoo finance:

- 80,097

- 16

- 174

- 245

To calculate it yourself you need to calculate the standard deviation (or variance but that is just the standard deviation squared) of the returns. Unfortunately the returns on stocks are distributed log-normally rather than normally but that isn't a problem as you can simply calculate it by log(p_t)-log(p_t-1) where p_t is the price for the current period and p_t-1 is the price for the previous period. This is simple to do in excel with a small catch; since you probably need intraday volatility for swing trading since you won't be holding the position over a significant time period you will need tick level data to calculate this and there can be billions of ticks a day for liquid stocks in a lively market. I have been writing an R script that does this, amongst other things, and calculates the Value at Risk (VaR) of the position which is a related measure at a set quantile of the distribution. R copes more than admirably with these calculations, other programming languages are likely to be about as good.

If you look at different methods of calculating and estimating VaR you'll get a good idea of how professionals quantify risk. Also see the Quant stack exchange.

If you're looking for something prepackaged have a look as RiskGrade volatility which is calculated similarly but which may be expensive and not available for all stocks or markets.

Note that beta mentioned in another answer is not ideal if you are trading between markets as it only takes into account the volatility compared to the market so doesn't include things like systemic risks which are removed by the expected market rate of return (read about CAPM for more details).

- 9,156

- 2

- 34

- 42

There are two:

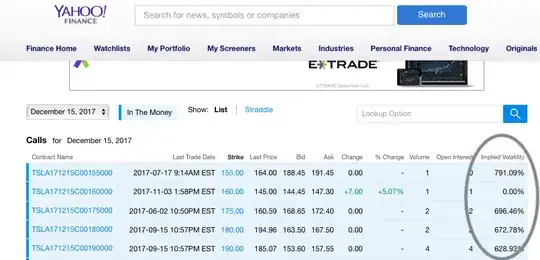

- Implied Volatility - the volatility in the underlying market implied by the price of options; and

- Historical Volatility - the volatility of the underlying security based on its recent history.

Implied Volatility is shown on the Yahoo Options Screen for each option:

Historical Volatility can be calculated, but will depend on your calculation methodology. Some brokers provide historical volatility information in their trading platforms.

- 5,191

- 11

- 38