I'm looking to solve this problem:

If I were to start investing now, With a 4% annual return compounded monthly what is the function for my return if my monthly input is initially $2000 then for every month here after 2% is added. For example:

month 1 deposit = 2000

month 2 deposit = 2040

month 3 deposit = 2080.80 etc.

I understand the compound interest formula with a uniform monthly deposit to be:

p*(i+1)^t + d * ((1+i)^t - 1)/(i) * (1+i)

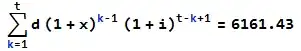

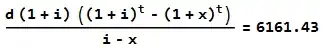

where p is our initial value, t is the number of compounding periods and d to be the periodic deposit. But I'm struggling to find the formula with the increase in the monthly deposit.

I have a feeling that there isn't a straight forward formula (I hope to be shown wrong!) but maybe it is possible to write a python script with a loop or a rrnewing d variable?