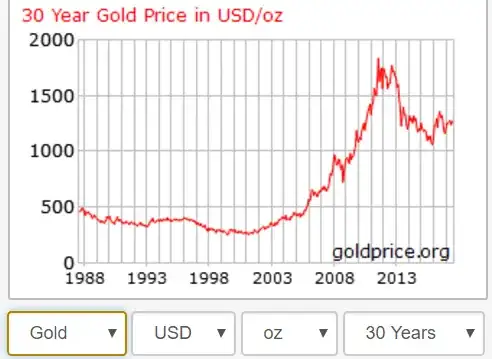

You know, we all have inflation. You can buy less on your USD, Euros and RUBs today than year before. I was advised to buy gold if I do not want my money be eaten by inflation. Gold is advised for long-term savings. However, I look at the goldprice.org

The price of gold is roughly constant. I ignore the 2008 spike. The constant means that you can buy as much gold per your dollar as you could a year ago. Yet, the dollar is cheaper today, so, the gram of gold must also be cheaper. The plot shows me that gold loses its value as much as the dollar and other printed currencies, it is subject to inflation. It shows that the gold value is eaten at the printed money inflation rate or gold is mined exponentially with time at money doubling rate. Is my observation right?