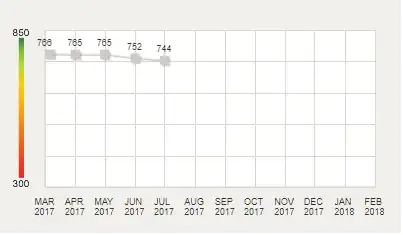

I looked up my Fico score for the first time in March of this year--it was 766. At that point, I had two credit cards, one that I used for almost everything and a store card that I hardly ever used. The following month, I applied for a margin trading account at my brokerage and it dropped a single point to 765. I have no debt and always pay my bills on time. (I had some unpaid hospital bills around 8 or 9 years ago...not sure if that could still be affecting my credit.)

My bank's website (Bank of America) suggested that a lack of available credit was negatively impacting my score so I signed up for another credit card to get an additional $5000 of credit in addition to the $9400 I already had.

Apparently this was a big mistake because it caused my score to drop to 744 between June and July. Now, the reasons for my low score include "length of time resolving accounts have been established" and "lack of recent installment loan information."

Obviously, there's nothing to do about the first other than to wait.(Patience has never been my strong suit). Regarding the second, I don't see any reason to buy something with an installment loan other than to improve my credit, which I don't think anyone would argue is a rational reason to intentionally take on debt.

Is there anything I can do to raise my score without having to take out a loan with interest? I read somewhere that there is a type of "installment loan" that you pay into over time and get the money back once you've paid a certain amount but I'm not sure if that will work in my situation.