I am participating in my company's ESPP. My share lots have two restrictions:

- A sales restriction of 18 months, which is what it sounds like: I can't sell the shares until I've held them for 18 months.

- A transfer restriction of 24 months.

So, what is a transfer restriction? I thought it meant that I can't transfer my shares to another broker. This seems pointless, since once I can sell my shares I can effectively transfer them to another broker, by transferring the cash. The only downside is the minor transaction fees. But maybe it means something else.

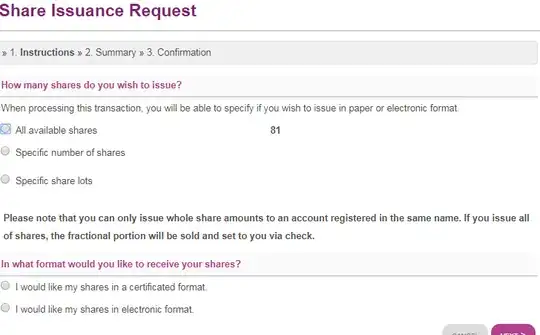

Here's the screenshot of what I see when I try to transfer a lot. I have no idea what "share issuance" means.

This is via Computershare, for what it's worth.

Hopefully the gist of my question makes sense.