I am a US citizen, and professionally I am an independent software developer contractor. I want to live in Vienna, Austria but still contract with companies from the United States and work remotely with those companies via the Internet. I will apply for my own residency in Austria myself.

Austria has extremely high taxes -- much higher than I am paying now in the United States. I'm trying to determine the best business structure in order to maximize tax efficiency while living in Austria.

I understand that there are other countries such as Malta, Gibraltar, and Lithuania that have low taxes. I also understand that I can start a business in one of these countries and legally leverage their accounting rules to maximize my tax efficiency. For instance, perhaps I could start a business in Malta and pay myself via dividends rather than via a salary.

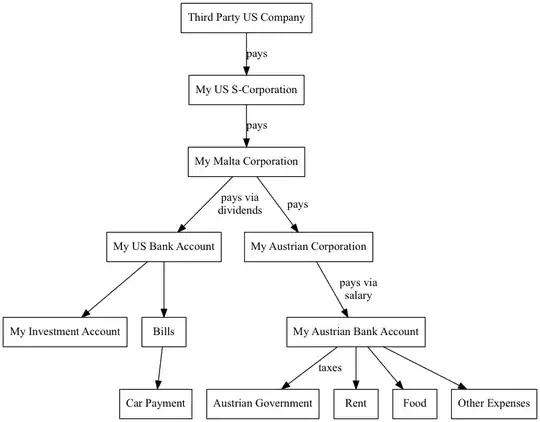

What are some options as far as navigating the business and tax laws in order to reach my outlined goals and achieve a legal, tax efficient business structure? I will speak with a tax advisor in Austria soon, but for now I just want to get a basic idea of my options. Here is what I have in mind so far: