I've always wondered but just now asking: What is meant by one being in a "tax bracket"? Does that mean only Federal, or does it include State AND Federal? For example: I (would like to) make $100K a year. Someone tells me you're in the 38% bracket. How do I interpret that? Are they talking about only Federal taxes? If so, then I would also be paying a chunk to California, let's say 15%, so where am I, in the 38% or in the 53%? Thanks in advance.

2 Answers

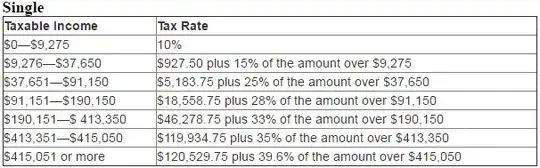

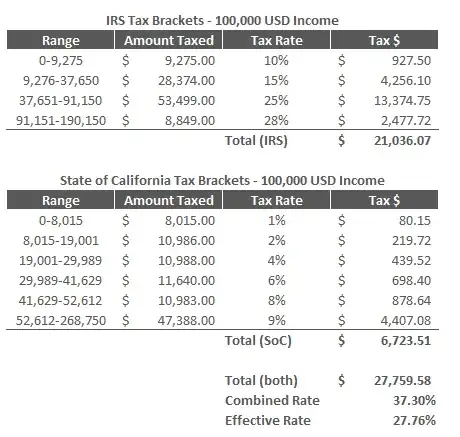

Tax brackets refer to the range of taxable within which you fall. An income tax bracket usually refers to federal or state tax, not the combined rate. I have put here the tax brackets for 2016 for IRS and State of California.

https://www.irs.com/articles/2016-federal-tax-rates-personal-exemptions-and-standard-deductions

https://www.ftb.ca.gov/forms/2016-california-tax-rates-and-exemptions.shtml

According to those, a taxable income of 100,000USD would fall in the 28% bracket for the IRS and 9.30% for State of California. The combined rate is therefore 37.3%. However, this does not mean you would pay 37,300USD. First of all, your applicable tax rate applies only for each dollar in your tax bracket (e.g. 28% * 8,849USD for IRS). Therefore, to calculate your combined taxes you would need to do:

Therefore, your effective tax rate would be much lower than the combined tax rate of 37.3%.

Now do note that this is an example to illustrate tax brackets and is nowhere near the amount of taxes you would be required to pay because of various credits and deductions that you would be able to benefit from.

Edit: As suggested in the comments, a note on marginal tax rate (referred to here as combined tax rate). This is the rate of taxes paid on an additional dollar of income. Here, every additional dollar of income would be taxed at 37.3%, leaving you with 62.7 cents.

- 2,279

- 15

- 18

As ApplePie discusses, "tax bracket" without any modifiers refers to a single jurisdiction's marginal tax rate. In your case, this is either your California's "tax bracket" or your Federal "tax bracket" (not including marginal Social Security and Medicare taxes). But if someone says "combined state and federal tax bracket", they probably mean the combination of your state and federal income tax brackets (again, lot including sales taxes, business and occupational taxes, social security taxes, and medicare taxes). The math to combine the state and federal marginal tax rates is a bit tricky, because most people can deduct either their state and local income taxes, or their state and local general sales taxes when computing their income for federal income tax purposes. (The federal "alternative minimum tax" restricts this deduction for some people.)

For a single person earning $ 100,000 of salaries and wages in California, whose state income taxes are close to their standard deduction, the calculations for the combined marginal income tax rate look something like this:

25 % Federal income tax bracket

9.3 % California income tax bracket

------

31.975 % = 25 % + (100 % - 25 %) * 9.3 %

= Combined income tax bracket.

As mentioned above, this understates the tax bite on marginal "earned income". To find the true marginal rate, we need to add in Social Security taxes, Medicare taxes, sales taxes, and business & occupation taxes. The Social Security and Medicare taxes are sometimes called "self employment taxes". This math omits unemployment insurance and workers' compensation insurance, because those taxes are typically capped well below $ 100,000 per year of income. This math also omits B & O taxes, because this question is California specific.

If an employer wishes to increase an employee's pay by $ 1,076.50, the first $ 76.50 will go to the employer's share of Social Security and Medicare taxes. The remaining $ 1,000.00 will be subject to the combined marginal income tax rate discussed above, plus will have $ 76.50 go to the employee's share of Social Security and Medicare taxes. The employee might buy some extra things with some of their extra money, and pay sales tax on them.

In 2016, a 9 % sales tax rate was common in California's largest cities. The IRS estimated that (for a single person with no dependents making $ 100,000 per year who did not buy a boat, RV, motor vehicle, or major home construction), about 9 % of their marginal gross income was subject to sales tax.

$ 1,076.50 Employer's increased expense

76.50 Employer's share of Social Security and Medicare taxes

250.00 Employee's federal tax bracket

93.00 Employee's state tax bracket

-23.25 Employee's savings on federal taxes because of state taxes

8.00 Estimated extra sales taxes.

76.50 Employee's share of Social Security and Medicare taxes

----------

480.75 Total taxes on marginal income

595.25 Net benefit to employee

----------

44.7 % = 480.75 / 1076.50

= true combined marginal tax rate.

- 3,517

- 16

- 24