Specifically, do odor removal and air duct cleaning count as tax-deductible home improvements?

4 Answers

In general, for a home you live in, there's maintenance, which is just that, you pay to keep your house in good repair.

There's also real improvements. I spend $xxx to turn my poured cement basement into living space. Here, I keep my receipts and the cost (although not my labor) is added to the basis of my home when I sell.

The couple things that may offer a deduction have to do with energy. When I insulated my basement, there was a state tax credit which I got back when I filed taxes. There are also credits for installing solar panels.

What you've described in your question just sounds like one of the small joys of home ownership.

- 172,694

- 34

- 299

- 561

On a personal income tax return home improvements are generally not deductible on a federal level. There might be some exceptions made for special tax programs, such as solar panels, but they tend to be the exception rather than the rule.

- 80,097

- 16

- 174

- 245

If the house is not used for business

As noted above but with sources

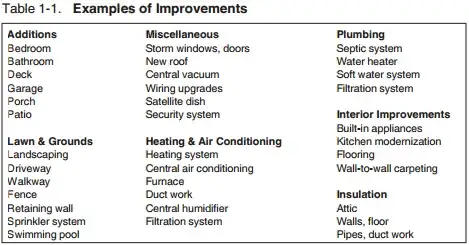

An improvement materially adds to the value of your home, considerably prolongs its useful life, or adapts it to new uses. You must add the cost of any improvements to the basis of your home. You cannot deduct these costs. Source Page 11, Adjusted Basis, Improvements

Second,

A repair keeps your home in an ordinary, efficient operating condition. It does not add to the value of your home or prolong its life. Repairs include repainting your home inside or outside, fixing your gutters or floors, fixing leaks or plastering, and replacing broken window panes. You cannot deduct repair costs and generally cannot add them to the basis of your home. Source Page 12, Adjusted Basis, Repairs versus improvements

But this is different if you are a lessor.

Generally, an expense for repairing or maintaining your rental property may be deducted if you are not required to capitalize the expense.

You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it results in a betterment to your property, restores your property, or adapts your property to a new or different use. Source Page 5, Repairs and Improvements

Good Luck,

- 1,096

- 5

- 13

Home Improvements that improve the home's Energy Efficiency are currently eligible for federal tax credits.

This includes renewable energy equipment (solar panels, etc.) and Nonbusiness Energy Property Tax Credit. The credit is 30% of the cost.

From Intuit Turbo Tax: Energy Tax Credit:

Equipment and materials can qualify for the Nonbusiness Energy Property Credit only if they meet technical efficiency standards set by the Department of Energy. The manufacturer can tell you whether a particular item meets those standards. For this credit, the IRS distinguishes between two kinds of upgrades.

The first is "qualified energy efficiency improvements," and it includes the following:

•Home insulation

•Exterior doors

•Exterior windows and skylights

•Certain roofing materialsThe second category is "residential energy property costs." It includes:

•Electric heat pumps

•Electric heat pump water heaters

•Central air conditioning systems

•Natural gas, propane or oil waterheaters

•Stoves that use biomass fuel

•Natural gas, propane or oil furnaces

•Natural gas, propane or oil hot water boilers

•Advanced circulating fans for natural gas, propane or oil furnaces

- 143

- 6