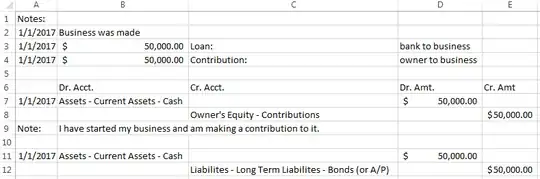

If I start a business (LLC, specifically) and incur some of the startup costs with my own money, how do I account for this in the bookkeeping once the LLC's bank account is up and running?

For instance, on my own personal books, I have an expense account which is labeled "LLC Startup Expenses". When I create the LLC, I want to be able to somehow move the start up expenses to reflect the fact that the LLC had these expenses, not me personally (e.g. zero out the "LLC Startup Expenses" on my own books). What is the best way to go about this?