I have a friend who is looking at purchasing this derivative product from JPMorgan. It looks more or less like it's pretty difficult to lose ( ie. not do better than investing in a plain s&p index fund), but I'm always very skeptical of these types of claims. I'm wondering what the catch is on this.

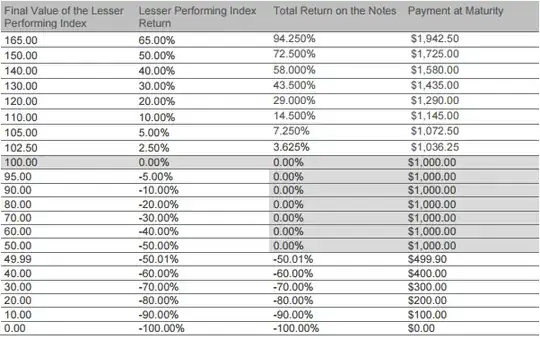

In short, the product guarantees 1.45x the upside of either the s&p 500 or the Russell 2000, whichever is lower. On the downside, your principle is completely protected until it (the lower of the two indices) falls to -50% at which point you don't get back 50% of your original investment and so on until your investment hits 0%. Here are the hypothetical returns:

I thought of a couple of risks but don't really get why they should cause the returns to be this high. I'll list them (mostly gotten from the "Selected Risks Considerations") and why I think that they're not a problem:

- You are only getting 1.45x the lower of either the s&p500 or the Russell 2000. I don't really think that this would be enough to make a significant difference. Comparing the two, they seem to move somewhat together (besides for the tech bubble, but that was a pretty unique situation where smaller cap companies were being bid up), so I wouldn't expect to do worse than an s&p 500 index fund because of that. Basically, I think that 1.45x the lower index will at least equal the other index (and more likely than not, surpass it). Here's a chart comparing them:

- Lack of liquidity. This friend is not planning on needing the money in the next 5 years anyway. Wherever the money is going to be placed is where it will be for the next 5 years and he is not looking for the best possible investment at every second. Also, the premium for this illiquidity doesn't seem (without clearly measuring it) like it would be enough to justify the 1.45x.

- It's subject to the credit risk of JPMorgan Financial Company LLC. JPMorgan Financial Company LLC has a credit rating of A3 from Moody's, so them defaulting is not such a large concern to me. Again, it doesn't seem to justify the returns being offered.

- No dividends. The s&p 500 has a dividend yield in the range of 2% and the Russell 2000 has one ~1.5%. This doesn't seem like it would be enough to make a difference either and certainly wouldn't justify the 1.45x.

Is there a catch here? It seems like it should be possible to beat the market without taking on significantly more risk, but everything that I know tells me that this is very unlikely. Is the risk just a combination of the above factors or is there something else that I'm missing? Should he invest in this (long term) over an index fund?