In general the accounting equation is Assets - Liabilities = Equity. So by changing one side (in your case your partners have added Assets) you automatically change the other (Equity). You don't want to transfer money out of your checking account here because you're not changing the amount of that asset.

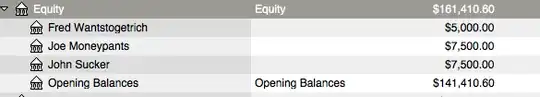

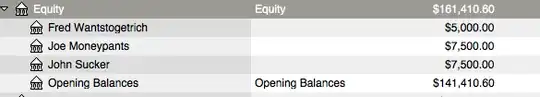

Rather, what you can do is transfer money from your Equity:Opening Balances account into each shareholder equity account (e.g. Equity:Shareholder1, Equity:Shareholder2 & Equity:Shareholder3). In this case you're not changing the Assets (and thus unbalancing your Checking account) and the accounting equation still balances.

If you need to track which expenses are attributable to a particular shareholder, you can create sub accounts in your checking account for the same purpose instead. In this case, the shareholders equity would decrease by the expense outlays (which is probably not what you want).

Edit based on comment:

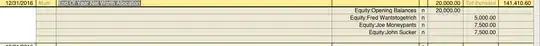

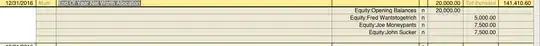

If you want to update the equity based on profit and loss for the year, you can perform a zero-sum entry in your Equity:Opening Balances and allocate the profit or loss to the individual partners. The screenshots below assume a 25%/37.5%/37.5% share amongst partners and a profit of $20K for the year.

And then in your Equity:Opening Balances account:

The main point is that you can't change the total amount of equity without changing your Assets or Liabilities (which contain the total profit/loss for the year) - hence the zero sum split.

Final Note:

Distributions to partners can be made directly out of their equity accounts. For example, if you write a check, then the entry in Assets:Checking would transfer from Equity:Joe Moneypants and his equity account would automatically reflect his decrease in equity due to the distribution.