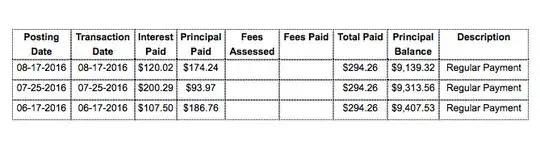

In my first payment on 06-17-2016, the principal applied to my balance was $186.76 and the interest was $107.50. As I kept making the payment on-time, the second payment on 07-25-2016 was a bit of a shock to me as the principle went down to $93.97 and the interest went up to $200.29.

I thought as I kept making payments on-time, the applied interest should decrease every time and the applied principal should increase. Am I wrong?