In a business environment, this phenomenon could be easily explained by 'operational leverage'. Operational leverage is the principle that increasing revenues by a small amount can have a disproportionately large impact on net income.

Consider this example: you run a business that rents out a factory and produces goods to sell to consumers. The rent costs you $10k / month, and all of your other costs depend on how many goods you produce. Assume each good gives you $10 in profit, after factoring your variable costs. If you sell 1,000 units, you break-even, because your variable profit will pay for your rent. If you sell 1,100 units, you make $1,000 net profit. If you sell 1,200 units, you double your overall profit, making $2,000 for the month. Operational leverage is the principle that adding incremental revenue will have a greater impact than the revenue already received, because your fixed costs are already 'paid for'.

Similarly in personal finance, consider these scenarios:

You have $1,000 in monthly expenses, and make $1,000 - your monthly savings (and therefore your wealth) will be zero.

You have $1,000 in monthly expenses, and make $1,100 - your monthly savings will be $100 per month.

You have $1,000 in monthly expenses, and make $1,200 - increasing your income by ~10% has allowed your monthly savings double, at $200 per month.

You have $1,000 in monthly expenses, and make $2,000 - your monthly savings are 5 times higher, when your income only increased by ~80%.

Now in the real world, when someone makes more money, they will increase their expenses. This is because spending money can increase one's quality of life. So the incline does not happen quite so quickly - as pointed out by @Pete & @quid, there comes a point where increased spending provides someone with less increase in quality of life - at that point, savings really would quickly ramp up as income increases incrementally. But assuming you live the same making $2,000 / month as $1,000 / month, you can save, every month, a full month's worth of living expenses. This doesn't even factor in the impact of earning investment income on those savings.

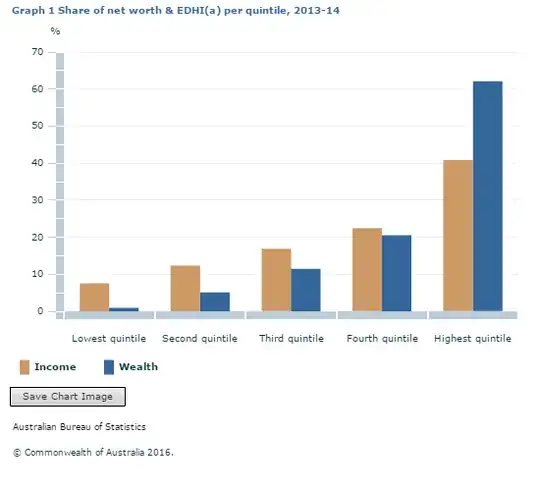

As to why the wealth exceeds income at that specific point, I couldn't say, but what I've outlined above should show how it is quite reasonable that the data is as-reported.